The Middle East’s gas pipeline infrastructure market is projected to reach a valuation of $23 billion by 2029, up from $17 billion in 2023, reflecting a compound annual growth rate (CAGR) of 5.65%. This growth underscores the region’s strategic shift toward natural gas as a cleaner energy source and its ambition to become a pivotal energy hub connecting Europe, Asia, and Africa.

Strategic Drivers of Growth

The surge in market value is propelled by several factors:

- Energy Transition Initiatives: Countries like Saudi Arabia and the UAE are diversifying their energy portfolios, aiming to reduce reliance on oil and coal. Saudi Arabia’s Vision 2030, for instance, targets a 50% share of gas and renewables in its energy mix by 2030.

- Technological Advancements: The adoption of smart pipeline technologies enables real-time monitoring, leak detection, and predictive maintenance, enhancing safety and efficiency. Innovations in pipeline materials and construction techniques further reduce costs and environmental impact.

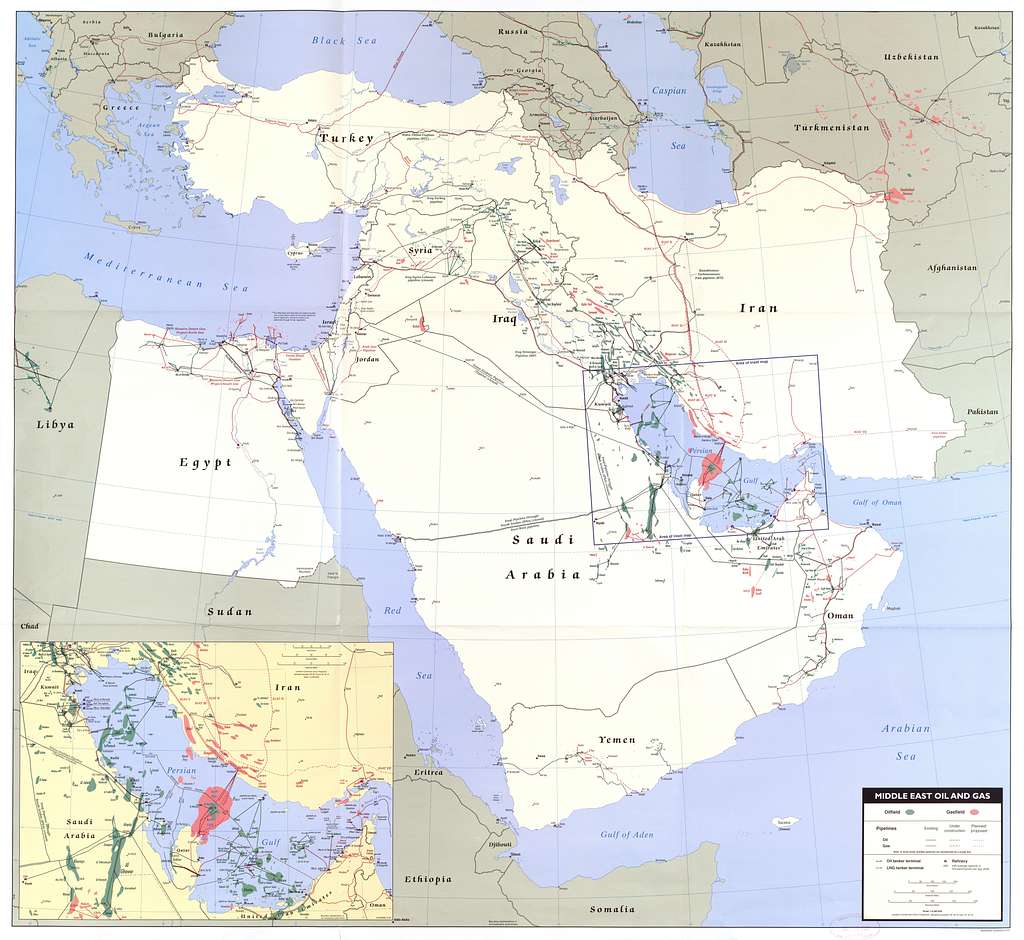

- Cross-Border Collaborations: Regional projects like the Dolphin Gas Project, linking Qatar’s North Field to the UAE and Oman, exemplify successful cross-border energy integration. Such initiatives bolster energy security and facilitate gas exports to neighboring countries.

Country-Specific Insights

- Saudi Arabia: As the largest market in the region, Saudi Arabia’s vast natural gas reserves, particularly in the Ghawar and Shaybah fields, necessitate extensive pipeline networks. The kingdom’s strategic investments aim to diversify its energy mix and position itself as a key energy supplier.

- Qatar: Known as the world’s largest LNG exporter, Qatar is investing in pipeline infrastructure to expand its LNG production capacity and meet growing international demand.

- UAE and Oman: Both nations are enhancing their gas processing and export facilities, supported by regional projects like the Dolphin Gas Project, to strengthen their roles in the global energy market.

Challenges and Considerations

Despite the positive outlook, the market faces challenges:

- Regulatory and Environmental Hurdles: Navigating complex regulatory landscapes and addressing environmental concerns can delay project timelines and increase costs.

- Geopolitical Factors: Political instability in certain regions may impact the feasibility and security of pipeline projects.

- High Capital Expenditure: The initial investment required for pipeline construction and maintenance remains substantial, necessitating careful financial planning and international partnerships.

The Middle East’s gas pipeline infrastructure market is poised for significant growth, driven by strategic energy policies, technological innovations, and regional collaborations. As the region continues to invest in and develop its gas infrastructure, it is set to play a crucial role in the global energy landscape, ensuring a reliable and sustainable energy supply for the future.